- #TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD FULL#

- #TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD SOFTWARE#

- #TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD CODE#

- #TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD PROFESSIONAL#

- #TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD FREE#

Must file by to be eligible for the offer.

TurboTax Live Basic Offer: Offer only available with TurboTax Live Basic and for simple tax returns only.

Special discount offers may not be valid for mobile in-app purchases. Actual prices are determined at the time of print or e-file and are subject to change without notice.

#TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD FREE#

TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for simple tax returns only offer may change or end at any time without notice.

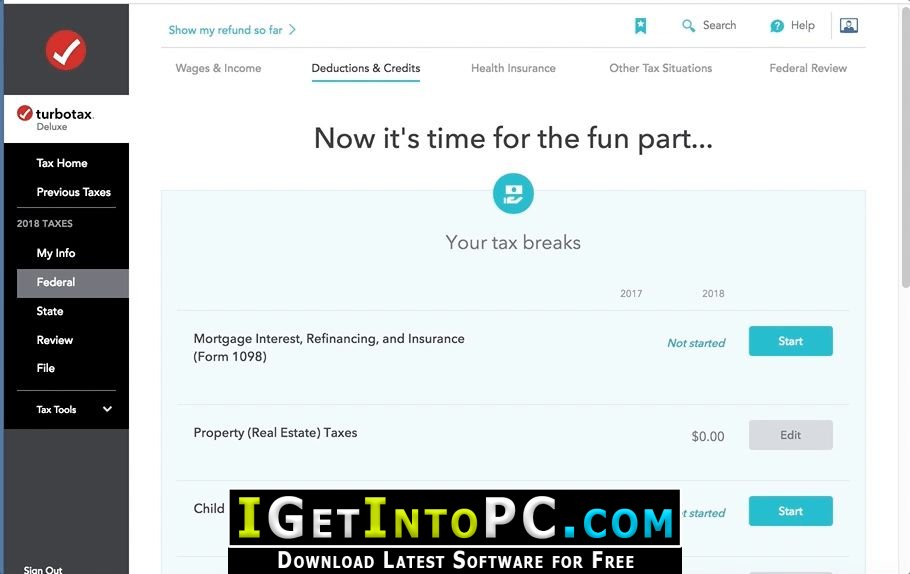

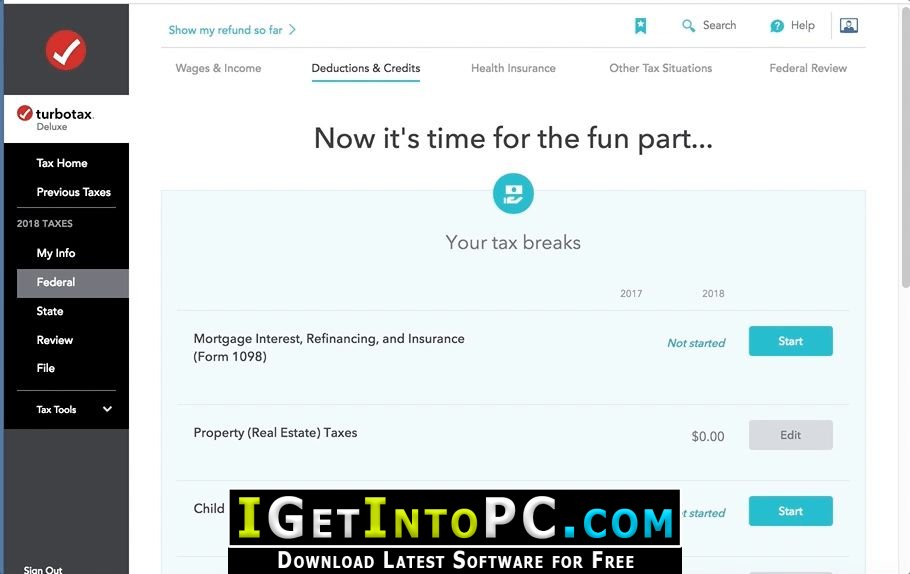

Try for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. #TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD FULL#

If you're not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

#TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD SOFTWARE#

If you bought or downloaded TurboTax software directly from us:. If you're not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you bought or downloaded TurboTax software from a retailer:. If you're not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). If you bought TurboTax Live from a retailer:.

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Satisfaction Guaranteed - or you don't pay. We will not represent you or provide legal advice. TurboTax Free Edition customers are entitled to payment of $30. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid.

#TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD PROFESSIONAL#

Audit Support Guarantee: If you received an audit letter based on your 2020 TurboTax return, we will provide one-on-one support with a tax professional as requested through our Audit Support Center for returns filed with TurboTax for the current tax year (2020) and the past two tax years (2019, 2018). 100% Accurate Expert Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. TurboTax Online Free Edition customers are entitled to payment of $30. Maximum Refund Guarantee - or Your Money Back: If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the applicable TurboTax federal and/or state purchase price paid. 100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Unemployment Income reported on a 1099-G. Limited interest and dividend income reported on a 1099-INT or 1099-DIV. A simple tax return is Form 1040 only (without any additional schedules) OR Form 1040 + Unemployment Income. TurboTax Free Guarantee: $0 Federal + $0 State + $0 To File offer is available for simple tax returns with TurboTax Free Edition. It can raise red flags about possible missed deductions, or items that seem unusually large or small in comparison to the prior year. Your previous year's return also is a great comparison tool once you think you have completed your current-year tax return. Shareholder or partner information if there are no changes. Your beginning balance sheet amounts (these are the same as the prior year's ending balance sheet amounts). The method you use to track your inventory (if applicable). #TURBOTAX BUSINESS FOR MAC 2015 DOWNLOAD CODE#

Your business code number and business activity descriptions. The date you elected to become an S corporation. The date you incorporated or started your business. The method you use to track your business finances (cash versus accrual). For example, if you are preparing your own return for the first time, your prior-year return can verify: It provides valuable information and can serve as a good roadmap for making your way through this year's return. Rather not remind yourself of all the tax you paid last year? Understandable, but you still need to dig out your previous year’s return.

0 kommentar(er)

0 kommentar(er)